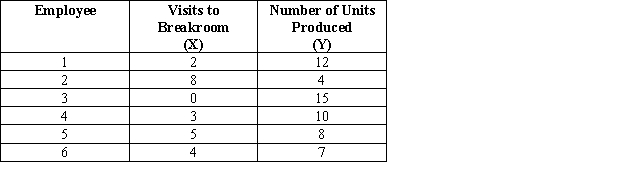

Calculate the appropriate correlation coefficient for the following data.

Definitions:

Out-Of-The-Money Call

An options contract where the market price of the underlying asset is below the strike price, rendering it unprofitable to exercise.

Nonsystematic Variance

The portion of an asset's total variance that is attributable to company-specific or industry-specific factors and can be mitigated through diversification.

Market Index

A hypothetical portfolio of investment holdings which represents a segment of the financial market, used as a benchmark to measure the performance of investments.

Q1: When <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4035/.jpg" alt="When is

Q1: False memory syndrome is an example of

Q3: A two-way ANOVA contains<br>A)a main effect for

Q4: In the original version of the Harvard

Q13: The logic behind samples and populations is

Q14: Find the mode of the following data

Q22: Which of the graphs below shows the

Q43: In general,a zero correlation means that<br>A)as the

Q51: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4035/.jpg" alt=" cannot ever be

Q59: If the population variance of the raw