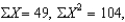

If  and

and  ,what is

,what is  ?

?

Definitions:

Narcissistic

Relating to narcissism, which is characterized by an excessive interest in or admiration of oneself and one's physical appearance, coupled with a lack of empathy for others.

Psychotherapy

A therapeutic treatment involving psychological techniques designed to assist individuals in overcoming difficulties and achieving personal growth.

Multicultural Factors

Aspects and influences that arise from different cultural, ethnic, and demographic backgrounds, affecting behaviors, attitudes, and beliefs.

Borderline Personality Disorder

A personality disorder characterized by repeated instability in interpersonal relationships, self-image, and mood, and by impulsive behavior.

Q3: Instructions: Circle the correct response in each

Q7: A study of the effect of IQ

Q14: The experimentwise error rate is defined as

Q18: A doctor wants to know how well

Q22: Suppose you have randomly selected high school

Q36: Julius has conducted a very small study

Q41: If you are interested in how well

Q49: Research into the social behavior of senior

Q50: Consider the following compound: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4942/.jpg" alt="Consider

Q54: Which of the following represents a Type