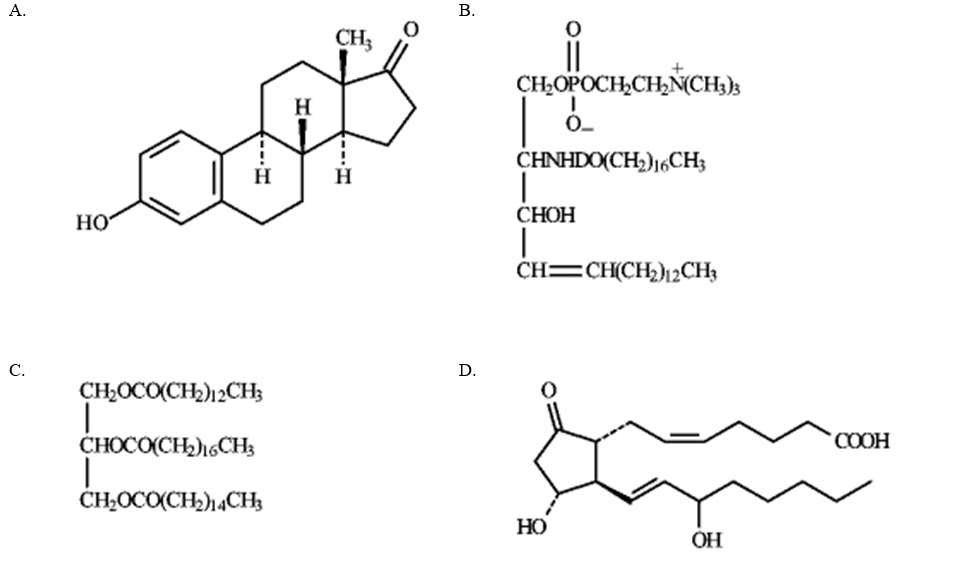

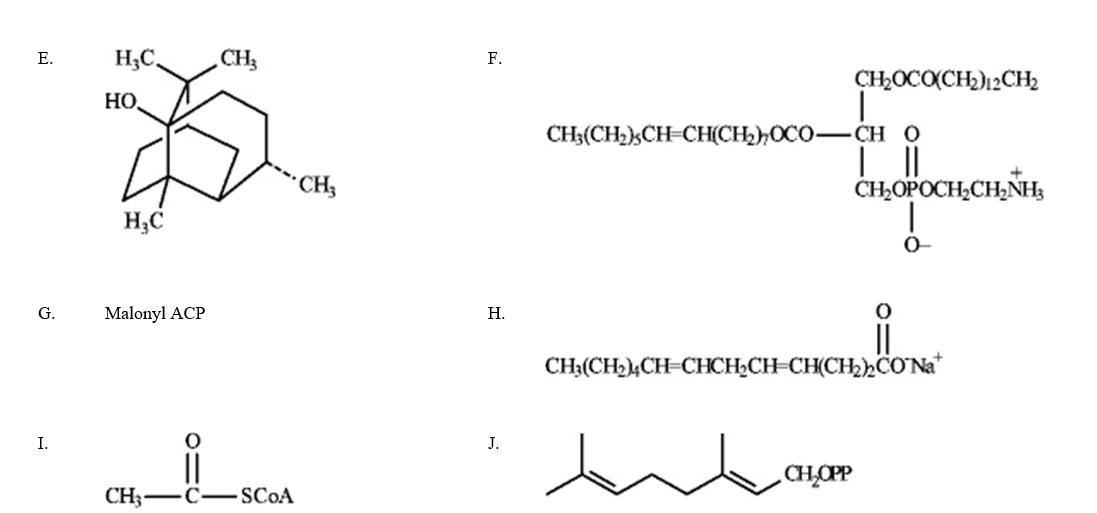

Instructions: Match each of the given terms to a structure from the list below. There is only one correct structure for each term, and structures may be used more than once.

Definitions:

Permanent Tax Difference

A discrepancy between taxable income and accounting income that will not reverse over time, affecting the tax and financial statements differently.

Taxable Income

The amount of income used to determine how much tax an individual or a company owes to the government in a given tax year.

Adjusted Pre-tax Book Income

Income calculated by making certain adjustments to the pre-tax income reported in the financial statements, often for tax or analytical purposes.

Uncertain Tax Positions

Tax positions taken in a filed tax return that may be challenged by the taxation authorities and which may have to be adjusted in the future.

Q3: Instructions: Consider the reaction below to answer

Q8: Which of the following regions in the

Q11: Instructions: Consider the data below to answer

Q14: An investor bought an 8% bond at

Q15: Instructions: Consider the reaction below to answer

Q16: Instructions: Refer to the mass spectrum of

Q17: Compute the mean, median, and mode of

Q17: Instructions: Predict the splitting patterns you would

Q27: Which of the following is not true

Q37: Which of the following characterizes the polymerase