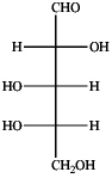

The monosaccharide shown below is

Definitions:

Average Tax Rate

The portion of an individual's overall income that goes towards taxes, determined by dividing the sum of taxes paid by the total income of the taxpayer.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating how much of an additional dollar of earnings will be taken as tax.

Taxable Income

The amount of income used to determine how much tax an individual or a company owes to the government, after all deductions and exemptions.

Social Security Tax

A tax that funds the Social Security program, which provides retirement, disability, and survivors' benefits.

Q3: Sam Cooper bought 200 shares of MTV

Q6: How many D-ketotetroses could exist?<br>A) none<br>B) one<br>C)

Q21: Which of the following fatty acids has

Q25: Consider the reactions below to answer

Q25: Allen Baker purchased ten $500 convertible bonds

Q28: Ralph bought 100 shares of Meredian stock

Q31: Instructions: Consider the following structure. Based on

Q38: Lyapolate Sodium, whose structure is shown below,

Q51: Sam Hanson bought 600 shares of DVG

Q63: Instructions: Give the major organic product(s) for