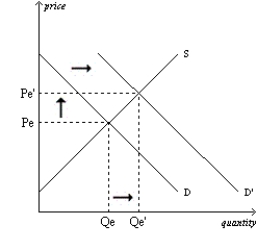

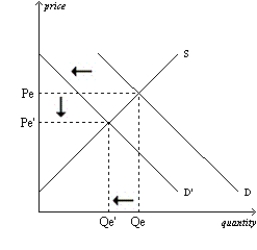

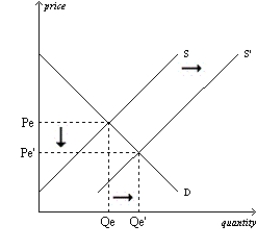

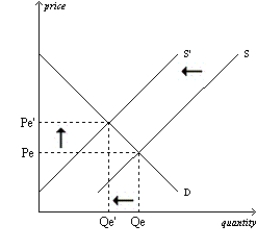

Figure 4-27

Panel (a)

Panel (b)

Panel (c)

Panel (c)

Panel (d)

-Refer to Figure 4-27. Which of the four panels illustrates an increase in quantity supplied?

Definitions:

Required Rate of Return

The minimum rate of return on an investment deemed acceptable by an investor, considering the investment's risk.

Internal Rate of Return

A financial metric used to evaluate the profitability of potential investments, calculating the discount rate that makes the net present value of all cash flows equal to zero.

Payback Period

Payback period is the duration required to recover the cost of an investment, calculated by dividing the initial investment by the annual cash inflow.

Net Present Value

A financial metric used to evaluate the profitability of an investment, calculated by subtracting the present value of cash outflows from the present value of cash inflows over a period of time.

Q163: Refer to Figure 5-9. Using the midpoint

Q238: Refer to Table 4-4. Suppose the market

Q250: If the price elasticity of demand for

Q251: Refer to Figure 4-23. In this market

Q296: The law of demand states that, other

Q349: The demand curve is the upward-sloping line

Q421: The law of demand is true for

Q483: If the demand for bananas is elastic,

Q586: In a perfectly competitive market, the goods

Q598: When quantity demanded has increased at every