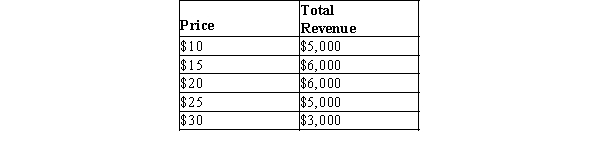

Table 5-6

-Refer to Table 5-6. Using the midpoint method, demand is unit elastic when quantity demanded changes from

Definitions:

Consumption Tax

A tax on the spending on goods and services, often levied as a sales tax, value-added tax (VAT), or goods and services tax (GST).

Saving

entails setting aside a portion of current income for future use, either by keeping the money in cash or placing it in some form of investment.

Tax-Advantaged

Refers to investments or accounts that are given preferential tax treatment, aiming to encourage saving and investment, often with benefits like deductions, credits, or exemptions.

IRA

An Individual Retirement Account, a savings plan that allows individuals to set aside money for retirement while offering tax advantages.

Q225: A bakery would be willing to supply

Q269: A price floor will be binding only

Q293: A decrease in the price of creamer

Q309: Demand for a good is said to

Q332: If a supply curve is horizontal, then

Q343: Individual supply curves are summed vertically to

Q380: An increase in the price of cheese

Q567: Suppose the income elasticity of demand is

Q573: A perfectly elastic demand implies that<br>A) buyers

Q594: When the market price is below the