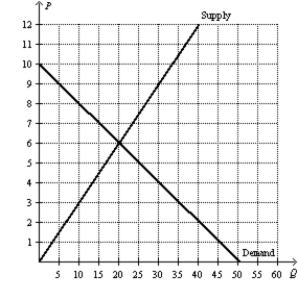

Figure 8-13

-Refer to Figure 8-13. Suppose the government places a $5 per-unit tax on this good. The amount of deadweight loss resulting from this tax is

Definitions:

Associate

An entity in which an investing entity has significant influence, typically through owning a substantial but not majority shareholding, usually between 20% and 50%.

Other Comprehensive Income

Represents items of income and expense that are not realized through the profit and loss account, including gains or losses from foreign currency translation and changes in the fair value of investments.

Debt Investments

Investments made by purchasing bonds or other debt instruments, offering returns in the form of regular interest payments.

IFRS And ASPE

International Financial Reporting Standards and Accounting Standards for Private Enterprises are guidelines for financial accounting.

Q132: All else equal, a decrease in demand

Q174: Refer to Figure 8-25. Suppose the government

Q255: A tax on insulin is likely to

Q306: Assume that for good X the supply

Q311: Within a country, the domestic price of

Q323: Market power refers to the<br>A) side effects

Q354: The nation of Farmland forbids international trade.

Q495: Refer to Figure 8-21. Suppose the government

Q496: Refer to Figure 8-2. The amount of

Q510: Producer surplus is the amount a seller