Scenario 8-3

Suppose the market demand and market supply curves are given by the equations:

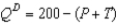

-Refer to Scenario 8-3. Suppose that a tax of T is placed on buyers so that the demand curve becomes:  If T = 40, how much tax revenue will be collected from this tax?

If T = 40, how much tax revenue will be collected from this tax?

Definitions:

Payroll Tax

Taxes that are imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their staff.

FICA Taxes

Taxes mandated by the Federal Insurance Contributions Act, which fund Social Security and Medicare, split between employers and employees.

Federal Income Taxes

Charges imposed by the national government on the yearly income of persons, businesses, trusts, and other legal bodies.

Payroll Tax Expense

Taxes that employers are required to pay on behalf of their employees, including contributions to social security, healthcare, and unemployment insurance.

Q95: Refer to Figure 9-17. Without trade, consumer

Q123: Refer to Scenario 7-2. How much is

Q151: When, in our analysis of the gains

Q160: A decrease in the size of a

Q179: Refer to Figure 9-26. Suppose the world

Q197: If Honduras were to subsidize the production

Q228: Relative to a situation in which gasoline

Q378: Refer to Figure 8-11. Suppose Q1 =

Q469: Refer to Figure 8-26. Suppose the government

Q502: When a tax is imposed on a