Scenario 8-3

Suppose the market demand and market supply curves are given by the equations:

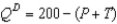

-Refer to Scenario 8-3. Suppose that a tax of T is placed on buyers so that the demand curve becomes:  If T = 40, how much will be the deadweight loss from this tax?

If T = 40, how much will be the deadweight loss from this tax?

Definitions:

Shifted

The movement of a supply or demand curve in a market due to changes in factors such as consumer preferences, production costs, or number of suppliers.

Corporate Income Tax

A tax imposed on the net income of a corporation that is derived from its business activities.

Shift

A change in the position of the supply curve or demand curve in a market, indicating a change in market conditions.

Efficiency Loss

The loss of economic efficiency in a market, which can occur due to various reasons, such as taxes, subsidies, or monopolies.

Q65: If the tax on a good is

Q77: The demand for beer is more elastic

Q177: Total surplus is always equal to the

Q212: Refer to Figure 8-11. The tax revenue

Q227: Suppose the demand curve and the supply

Q249: Refer to Figure 8-11. The length of

Q265: Which of the following is not a

Q359: Refer to Figure 9-10. When trade takes

Q362: If a country's domestic price of a

Q478: Refer to Figure 9-18. If Isoland allows