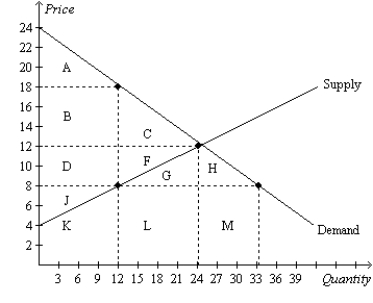

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.After the tax goes into effect,consumer surplus is the area

Definitions:

Equal Protection Clause

A provision in the Fourteenth Amendment of the U.S. Constitution requiring states to treat all individuals within its jurisdiction equally under the law.

Fourth Amendment

A provision in the United States Constitution protecting citizens against unreasonable searches and seizures by the government.

Foreign Corporation

A business entity that is registered and operates in a different country from where it was originally incorporated.

Certificate of Authority

An official document granting a company the right to conduct its business in a jurisdiction outside of where it was originally incorporated.

Q6: Refer to Scenario 8-3. Suppose that a

Q127: Refer to Figure 7-14. If the market

Q268: Refer to Figure 7-15. When the price

Q272: Suppose the government increases the size of

Q313: Assume the supply curve for cigars is

Q337: Refer to Figure 9-1. From the figure

Q343: When a tax is levied on buyers,

Q396: The more elastic the supply, the larger

Q407: Total surplus<br>A) can be used to measure

Q432: The cost of production plus producer surplus