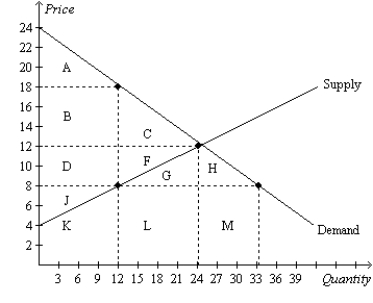

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.The deadweight loss of the tax is the area

Definitions:

Dividend Payment Capacity

The ability of a company to make dividend payments to its shareholders, often assessed by its free cash flow or earnings.

Non-controlling Interest

A minority share of ownership in a subsidiary that is not owned by the parent company, reflected in consolidated financial statements to show the portion of the subsidiary's earnings not attributed to the parent.

Consolidated Equity

The total equity in a consolidated financial statement, combining the parent company's and its subsidiaries' equity.

Parent Interest

Refers to the portion of equity in a subsidiary attributable directly to the parent company, excluding any minority or non-controlling interests.

Q97: Refer to Figure 8-14. Which of the

Q115: Refer to Figure 9-3. If China were

Q133: Refer to Figure 9-3. The increase in

Q159: Suppose Japan exports cars to Russia and

Q323: The government's benefit from a tax can

Q370: If a country allows trade and, for

Q382: The loss in total surplus resulting from

Q466: In terms of gains from trade, why

Q470: Inefficiency can be caused in a market

Q502: When a tax is imposed on a