Multiple Choice

Figure 8-21

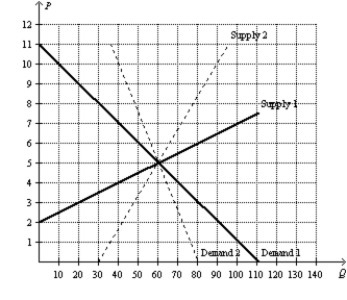

-Refer to Figure 8-21.Suppose the market is represented by Demand 1 and Supply 1.At first the government places a $3 per-unit tax on this good.Then the government decides to raise the tax to $6 per unit.Compared to the original tax rate,the higher tax will

Definitions:

Related Questions

Q4: A tariff is a tax placed on<br>A)

Q5: When a country abandons a no-trade policy,

Q55: If the labor supply curve is very

Q204: Refer to Figure 8-9. The imposition of

Q208: Assume that for good X the supply

Q232: What happens to the total surplus in

Q243: Taxes cause deadweight losses because they prevent

Q247: A tax affects<br>A) buyers only.<br>B) sellers only.<br>C)

Q439: A tax on a good<br>A) gives buyers

Q490: Refer to Figure 8-9. The imposition of