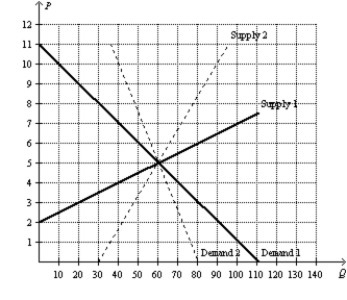

Figure 8-21

-Refer to Figure 8-21.Suppose the market is represented by Demand 1 and Supply 1.At first the government places a $3 per-unit tax on this good.Then the government decides to raise the tax to $6 per unit.How would you characterize the decision to raise the tax rate from $3 to $6 per unit? The decision is

Definitions:

Excise Tax

A specific tax levied on certain goods, services, or activities, often included in the price of things like gasoline, alcohol, and tobacco.

Equilibrium Output

The level of output at which the quantity of goods produced equals the quantity of goods demanded, with no excess supply or demand in the market.

Perfectly Inelastic

Describes a situation where the quantity demanded or supplied does not change despite changes in price.

Excise Tax

A tax imposed on the sale of specific goods and services, such as tobacco, alcohol, and gasoline.

Q23: Who once said that taxes are the

Q129: Refer to Figure 8-10. Suppose the government

Q227: When a country allows trade and becomes

Q339: Refer to Figure 8-9. The per-unit burden

Q348: Refer to Figure 8-7. Which of the

Q417: Refer to Figure 7-34. Suppose there is

Q427: The demand for energy drinks is more

Q461: A tax<br>A) lowers the price buyers pay

Q464: Which of the following tools help us

Q475: Connie can clean windows in large office