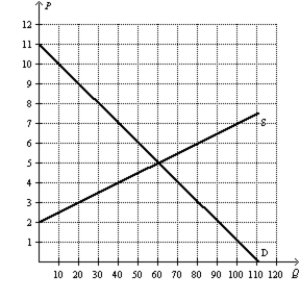

Figure 8-22

-Refer to Figure 8-22.Suppose the government initially imposes a $3 per-unit tax on this good.Now suppose the government is deciding whether to lower the tax to $1.50 or raise it to $4.50.Which of the following statements is not correct?

Definitions:

Cost of Goods Sold

Direct expenditures involved in producing the merchandise a business sells.

FIFO Cost Flow

An inventory valuation method where the first items purchased are the first ones to be sold, assuming costs rise over time.

Ending Inventory

The total value of goods available for sale at the end of an accounting period, calculated by adding purchases to the beginning inventory and subtracting the cost of goods sold.

Laptop Computers

Portable personal computers designed for mobile use, characterized by a screen and a keyboard.

Q54: Refer to Figure 7-32. If the government

Q73: Supply-side economics is a term associated with

Q158: Refer to Figure 9-20. With trade, Vietnam

Q177: Refer to Scenario 9-1. If trade in

Q182: Refer to Figure 8-11. The price labeled

Q354: Refer to Figure 8-6. When the tax

Q394: When a tax is imposed, the loss

Q402: A tax places a wedge between the

Q453: The infant-industry argument<br>A) is based on the

Q499: Consumer surplus is the amount a buyer