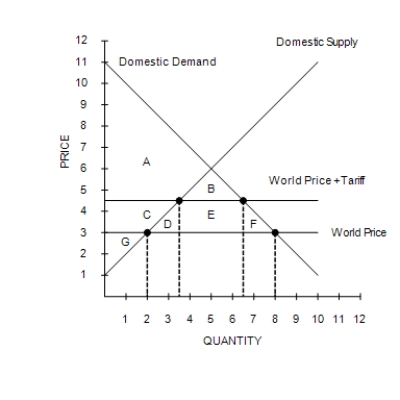

Figure 9-6

-When a country that imported a particular good abandons a free-trade policy and adopts a no-trade policy,

Definitions:

Top Quintile

Refers to the highest fifth or 20% segment of a population or group sorted by a particular metric, often used in the context of income distribution.

Progressive Tax

A tax system where the tax rate increases as the taxable amount increases, typically aimed at redistributing wealth more equitably.

Value-Added Tax (VAT)

A type of tax that is applied incrementally at each stage of production and distribution on the value added to goods and services.

Retail Sales Tax

A tax on the sale of goods and services that is usually calculated as a percentage of the purchase price and collected by the retailer.

Q107: Relative to a situation in which domestic

Q119: When a country that imported a particular

Q149: William and Jamal live in the country

Q151: When, in our analysis of the gains

Q256: Which of the following represents a way

Q327: Refer to Figure 9-24. Suppose the government

Q343: Suppose that Australia imposes a tariff on

Q365: The less freedom young mothers have to

Q383: Refer to Scenario 10-1. Suppose the equilibrium

Q442: Refer to Figure 9-16. Government revenue raised