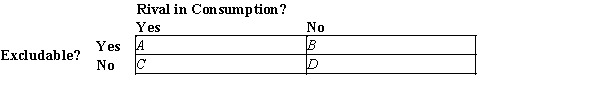

Figure 11-1

-Refer to Figure 11-1. The box labeled D represents

Definitions:

AGI

Adjusted Gross Income, which is total income minus specific deductions, serving as a determinant for various tax credits and deductions.

Pension Plan

A type of retirement plan that typically provides retirees with a fixed payout upon retirement, funded by employer, employee contributions, or both during their employment years.

Coverdell Education

A savings account designed specifically for paying education expenses, with tax advantages, for a designated beneficiary.

AGI

Adjusted Gross Income, which is the total gross income minus specific deductions allowable by the IRS, forming the basis for calculating taxable income.

Q29: Which of the following policies is not

Q60: State and local governments receive the largest

Q82: Why do elephants face the threat of

Q178: In terms of their economic effects, which

Q186: Which of the following is not true

Q199: Goods that are rival in consumption include

Q199: Refer to Figure 10-13. In order to

Q441: Corrective taxes are typically advocated to correct

Q443: An efficient tax system is one that

Q469: A positive externality<br>A) is a benefit to