Table 11-2

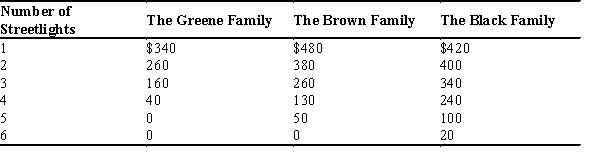

Consider a small town with only three families, the Greene family, the Brown family, and the Black family. The town does not currently have any streetlights so it is very dark at night. The three families are considering putting in streetlights on Main Street and are trying to determine how many lights to install. The table below shows each family's willingness to pay for each streetlight.

-Refer to Table 11-2. Suppose the cost to install each streetlight is $900 and the families have agreed to split the cost of installing the streetlights equally. To maximize their own surplus, how many streetlights would the Black's like the town to install?

Definitions:

Social Security Benefits

Payments made to eligible individuals by the government, including retirement, disability, and survivor benefits.

Progressive Tax

Places greater burden on those with best ability to pay and little or no burden on the poor (for example, federal personal income tax).

Proportional Tax

A tax whose burden falls equally among the rich, the middle class, and the poor.

Regressive Tax

A taxation system where the tax rate decreases as the taxable amount increases, leading to a higher tax burden on lower-income individuals relative to higher-income individuals.

Q1: Sue earns income of $80,000 per year.

Q4: Imagine a 2,000-acre park with picnic benches,

Q17: Which of the following are taxed?<br>A) both

Q29: Which of the following statements is not

Q121: Suppose the government issues a limited number

Q233: At the local park there is a

Q233: Which of the following is not a

Q402: Nine friends who love the beach decide

Q413: If New York City imposed a 50

Q461: Organizers of an outdoor concert in a