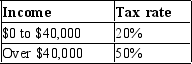

Table 12-3

-Refer to Table 12-3. What is the average tax rate for a person who makes $60,000?

Definitions:

Step-down Method

An accounting method used for allocating indirect costs to different departments based on a hierarchy where the first allocation base is the costliest department.

Personnel Department

The division of a business that is focused on activities relating to employees, such as hiring, training, and benefits administration.

Number Of Employees

The total count of individuals employed by a business or organization at a specific point in time.

Step-down Method

A method used in accounting to allocate service department costs to production departments in stages.

Q18: In 2011, state and local government education

Q32: Which of the following statements is correct?<br>A)

Q67: In 2010, the cochairmen of President Obama's

Q195: Goals of efficiency and equity in tax

Q256: The Occupational Safety and Health Administration (OSHA)

Q273: Seymour owns 3 acres of beautiful waterfront

Q366: A pair of jeans is rival but

Q419: A mortgage interest deduction would be considered<br>A)

Q423: Which two types of goods are rival

Q481: A tax on the wages that a