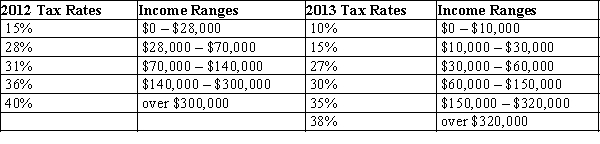

Table 12-9

United States Income Tax Rates for a Single Individual, 2012 and 2013.

-Refer to Table 12-9. Ruby Sue is a single person whose taxable income is $100,000 a year. What is her marginal tax rate in 2013?

Definitions:

Standard Deviation

A statistic that measures the dispersion or variability of a dataset relative to its mean, indicating how spread out the data points are.

Shaded Areas

In graphical representations, portions filled with color or patterns to distinguish them, often used to represent specific values, ranges, or sections in diagrams and charts.

Z-scores

Normalized values reflecting the distance of an element in terms of standard deviations from the mean.

Variable

A variable is an element, feature, or factor that is prone to vary or change, capable of taking on different values.

Q240: The deadweight loss of a tax is<br>A)

Q240: In almost all cases of common resources,

Q255: Refer to Scenario 13-6. Ziva's economic profit

Q307: Eldin is a house painter. He can

Q313: Refer to Scenario 13-11. An economist would

Q321: Suppose New York City passes a local

Q363: Refer to Scenario 13-9. According to Ellie's

Q439: Some colleges charge all students the same

Q466: In 2011, approximately how much of federal

Q525: A lump-sum tax would take different amounts