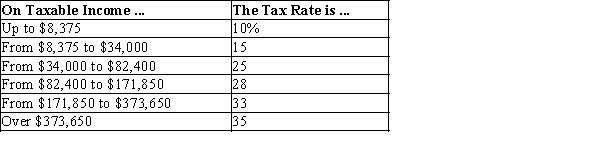

Table 12-10

-Refer to Table 12-10. If Willie has $170,000 in taxable income, his tax liability will be

Definitions:

Ownership Percentage

The fraction of a company's shares owned by a particular shareholder, representing their portion of control and claim on assets.

GAAP

Generally Accepted Accounting Principles, the standard framework of guidelines for financial accounting used in any given jurisdiction, particularly in the United States.

Exert Influence

To exert influence means to use power, authority, or persuasion to affect or direct others' actions, decisions, or opinions.

Investee Company

A company in which another entity has an ownership interest, signifying a partial or full influence over the company despite not having full control.

Q18: Which of the following can be added

Q28: Refer to Table 12-9. Ruby Sue is

Q43: Refer to Table 12-2. Suppose that the

Q55: When the government levies a tax on

Q67: In 2010, the cochairmen of President Obama's

Q92: Accounting profit is equal to<br>A) marginal revenue

Q218: An optimal tax is one that minimizes

Q228: Suppose the government levies a "fat tax"

Q328: What do we mean when we say

Q361: A production function describes<br>A) how a firm