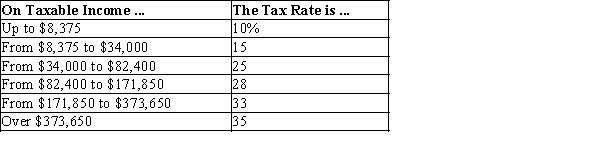

Table 12-10

-Refer to Table 12-10. If Jace has $33,000 in taxable income, his average tax rate is

Definitions:

Pure Competition

A market structure characterized by a large number of buyers and sellers, similar products, and free entry and exit, leading to price determination by supply and demand forces.

Monopolistic Competition

A market structure where many businesses sell products that are similar but not identical, allowing for competition based on price, quality, and marketing.

Pure Monopoly

A market structure where a single seller controls the entire supply of a product or service, and where entry of new competitors is obstructed.

Oligopoly

A market structure characterized by a small number of firms whose decisions about pricing and output can significantly affect competitors.

Q5: Which of the following in not a

Q74: A consumption tax is a tax on<br>A)

Q110: The nature of a firm's cost (fixed

Q118: If tax revenues from a tax on

Q213: According to the benefits principle, it is

Q281: Leonard, Sheldon, Raj, and Penny each like

Q325: By driving onto a congested road for

Q344: Taxes create deadweight losses because they<br>A) reduce

Q364: Is a tornado siren excludable? Is it

Q530: You are trying to design a tax