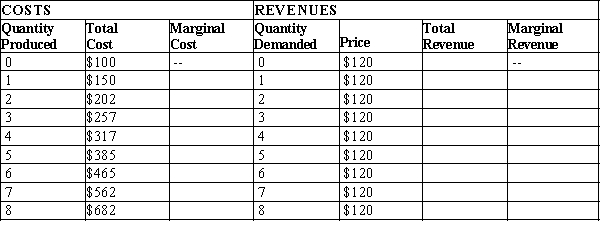

Table 14-6

The following table presents cost and revenue information for a firm operating in a competitive industry.

-Refer to Table 14-6. What is the total revenue from selling 7 units?

Definitions:

Sales Tax

A consumption tax imposed by the government on the sale of goods and services.

Structural

Relating to the underlying or foundational aspects or structures of a system, organization, or building.

Lump-Sum Tax

A tax that is a fixed amount and does not vary with the taxpayer's income or consumption levels.

Proportional Tax

A tax system where the tax rate remains constant regardless of the amount subject to tax, meaning everyone pays the same proportion of their income.

Q11: Refer to Table 13-20. Firm A is

Q11: Mrs. Smith operates a business in a

Q39: Profit is defined as total revenue<br>A) plus

Q134: Assume a firm in a competitive industry

Q193: Bubba is a shrimp fisherman who catches

Q217: Riva crafts and sells hard cider as

Q257: If Kevin's children run a lemonade stand

Q278: Refer to Scenario 13-1. If Korie purchases

Q348: When a profit-maximizing firm's fixed costs are

Q425: If there is an increase in market