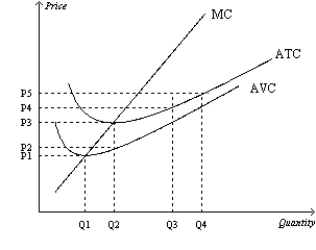

Figure 14-6

Suppose a firm operating in a competitive market has the following cost curves:

-Refer to Figure 14-6. Firms will earn positive profits in the short run if the market price

Definitions:

Discounted Cash Flow Technique

Considers both the estimated total net cash flows from the investment and the time value of money.

Net Present Value Method

A method used in capital budgeting to evaluate the profitability of an investment or project, by calculating the difference between the present value of cash inflows and outflows.

Internal Rate Of Return Method

A method of calculating the profitability of potential investments where the net present value of all cash flows equals zero.

Capital Budgeting

Capital Budgeting is the process by which organizations evaluate potential major projects or investments to determine their value and allocation of capital.

Q34: In the long run,<br>A) competitive firms' profits

Q99: Refer to Figure 14-14. If the market

Q116: Which of the following firms is the

Q189: The opportunity cost of capital is an

Q218: A competitive firm's profit will be increasing

Q348: Refer to Figure 15-7. In order to

Q352: A monopoly firm is a price<br>A) taker

Q401: A firm's total profit equals its marginal

Q430: An industry is a natural monopoly when<br>A)

Q539: In a perfectly competitive market, the process