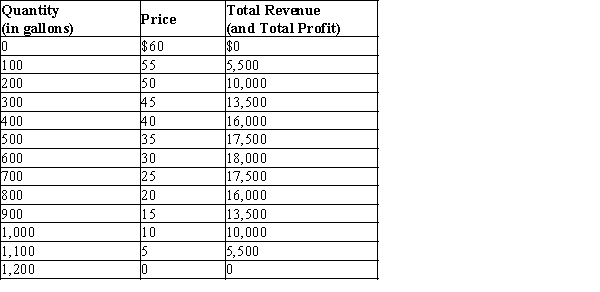

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The town's weekly demand schedule and total revenue schedule for water is shown in the table below:

-Refer to Table 17-1. If the market for water were perfectly competitive instead of monopolistic, how many gallons of water would be produced and sold?

Definitions:

Risk-Adjusted Return

A measure of the return on an investment relative to the risk taken, often used to compare the performance of investment options.

Sharpe Measure

An alternative term for the Sharpe Ratio, providing an assessment of an investment's risk-adjusted return by calculating the excess return per unit of risk.

Beta

A tool for appraising the degree of volatility or systemic risk involved in a security or portfolio relative to the market at large.

Treynor Measure

A ratio used to evaluate the returns of a portfolio or investment adjusted for risk, taking into account the risk-free rate and market volatility.

Q10: One way that public policy encourages cooperation

Q200: As the number of firms in an

Q235: Refer to Table 17-26. If both firms

Q255: Refer to Figure 16-9. For this firm,

Q349: Which of the following statements is correct?<br>A)

Q355: In some countries, brand name fast-food restaurants

Q431: Refer to Table 17-13. Suppose the owners

Q448: When a firm exits a monopolistically competitive

Q453: The prisoners' dilemma game<br>A) provides insight into

Q558: Refer to Figure 16-2. Suppose ATC =