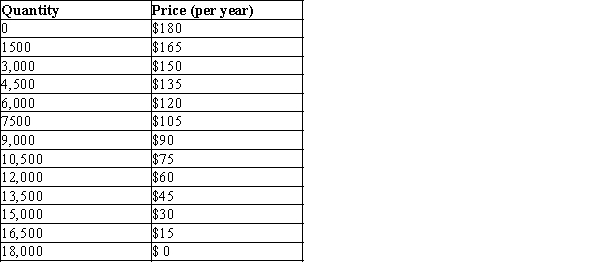

Table 17-5

The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

-Refer to Table 17-5. Assume there are two digital cable TV companies operating in this market. If they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions, then their agreement will stipulate that

Definitions:

Tax Rate

The percentage at which an individual or entity is taxed on their income or property.

Employee Stock Ownership Plans

Retirement plans designed to give employees ownership interest in the company by allowing them to acquire stock, contributing to company success and employee benefit.

Tax Advantages

Financial benefits derived from specific tax laws or regulations that reduce the amount of tax payable to federal or state governments.

Risk-Free Retirement

A concept of planning for retirement in a way that minimizes exposure to financial risks and uncertainties.

Q31: Refer to Figure 16-13. Use the letters

Q46: Predatory pricing refers to<br>A) a firm selling

Q73: A law that restricts the ability of

Q152: Which government entity is charged with investigating

Q175: Refer to Figure 16-9. The firm's maximum

Q177: Refer to Scenario 17-3. Building new weapons

Q297: Much of the research on game theory

Q445: Refer to Table 17-34. Is there a

Q447: In which of the following product markets

Q472: To move the allocation of resources closer