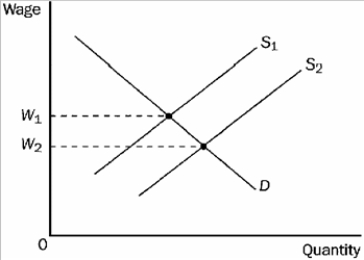

Figure 18-7

-Refer to Figure 18-7. Assume W1 = $15 and W2 = $12, and the market is always in equilibrium. A shift of the labor supply curve from S1 to S2 would

Definitions:

Average Tax Rate

The average tax rate is the percentage of total income that an individual or corporation pays in taxes, calculated by dividing total tax paid by total income.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the rate applied to each additional dollar of income.

Social Security Tax

A payroll tax collected to fund the Social Security program, which provides benefits to retirees, disabled individuals, and survivors.

Taxable Income

The portion of income subject to tax by the government after all deductions and exemptions.

Q34: Which of the following prohibits executives of

Q46: Predatory pricing refers to<br>A) a firm selling

Q60: In the prisoners' dilemma game, confessing is

Q85: The statement that "coal miners are paid

Q272: Which term do economists use to refer

Q328: Suppose that a new invention increases the

Q372: Refer to Table 17-24. Which firm's dominant

Q396: The manufacturer of South Face sells jackets

Q404: A plumber who specializes in cleaning plugged

Q489: When economists refer to a firm's capital,