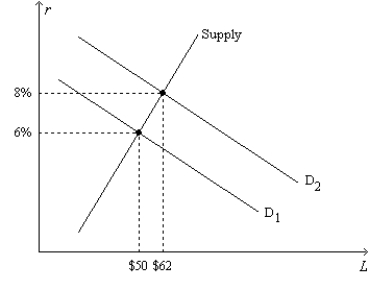

Figure 26-4.On the horizontal axis of the graph,L represents the quantity of loanable funds in billions of dollars.

-Refer to Figure 26-4.If the equilibrium quantity of loanable funds is $50 billion and if the equilibrium nominal interest rate is 8 percent,then

Definitions:

Conditional Sales Contracts

Conditional sales contracts are agreements where the sale of goods or property is contingent upon certain conditions being met, often involving payment installments and the retention of ownership by the seller until conditions are fulfilled.

Sale-On-Approval Contracts

Contracts that allow the buyer to take possession of goods before deciding whether to complete the purchase based on satisfaction with the item.

Sale-Or-Return Contracts

Agreements where goods are provided to a buyer with the option to purchase or return them within a specified period.

Mixed Sale

A transaction that involves both goods and services, requiring different legal considerations than the sale of pure goods or services alone.

Q6: Refer to Figure 27-2. From the appearance

Q49: Diversification reduces<br>A) only market risk.<br>B) only firm-specific

Q133: Which of the following would likely make

Q160: The country of Bienmundo does not trade

Q229: A U.S. Treasury bond is a<br>A) store

Q309: The country of Growpaw does not trade

Q382: Refer to Figure 27-4. From the appearance

Q451: The ratio of government debt to GDP

Q477: The rule of 70 can be stated

Q498: Long-term bonds are<br>A) riskier than short-term bonds,