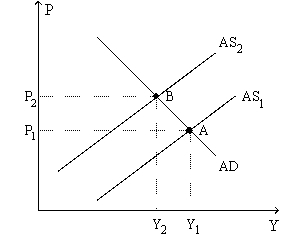

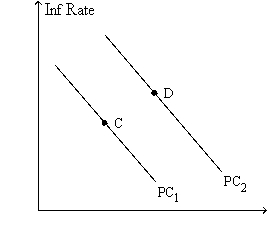

Figure 35-9. The left-hand graph shows a short-run aggregate-supply SRAS) curve and two aggregate-demand AD) curves. On the right-hand diagram, "Inf Rate" means "Inflation Rate."

-Refer to Figure 35-9. The shift of the aggregate-supply curve from AS1 to AS2

Definitions:

Coupon Bonds

Financial securities that pay periodic interest payments and return the principal at maturity.

Market Interest Rates

The current rates at which borrowers can obtain loans or income from investing, influenced by supply and demand in the financial markets.

Par

The face value or nominal value of a bond, stock, or other financial instrument, typically the amount on which interest payments or dividends are calculated.

Zero-Coupon Bond

A debt security that does not pay periodic interest, instead being sold at a discount and maturing at face value, generating profit at redemption.

Q78: Suppose that businesses and consumers become much

Q189: The effects of a decline in the

Q190: Suppose that the central bank must follow

Q294: The most important automatic stabilizer is<br>A) open-market

Q342: There are three factors that help explain

Q361: Time inconsistency will cause the<br>A) short-run Phillips

Q375: A decrease in the growth rate of

Q376: According to Friedman and Phelps, the unemployment

Q462: The multiplier is computed as MPC /

Q486: Refer to Figure 35-7. The economy would