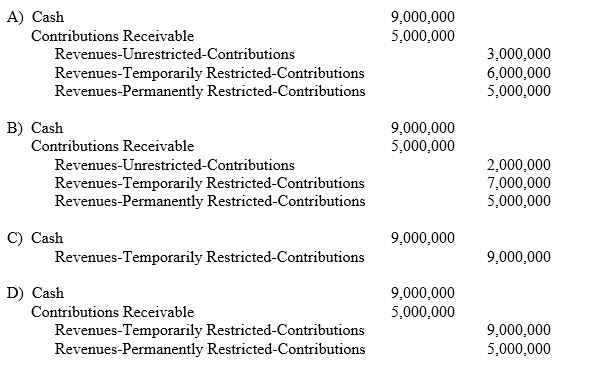

St. David's Hospital, a not-for-profit business oriented hospital, had contributions totaling $14,000,000 as follows: $2,000,000 for unrestricted purposes for the following year and beyond; $6,000,000 for construction of a new surgery wing which is scheduled to be built in the following year, $5,000,000 pledged for endowment purposes and $1,000,000 restricted for purposes other than long term asset acquisition. The endowment was a pledge; all other contributions were received in cash.

What is the hospital's journal entry?

Definitions:

Q2: During the month of December, Mary &

Q3: Financial reports for state and local governments

Q11: What is the purpose of the Unrelated

Q22: What does the acronym CAFR stand for?<br>A)

Q30: Which of the following are true of

Q35: Capitalized fixed assets are reported in which

Q85: Which of the following is true regarding

Q90: Higher education institutions that report as engaged

Q120: Reporting requirements are a combination of requirements

Q167: The Single Audit Act is intended to