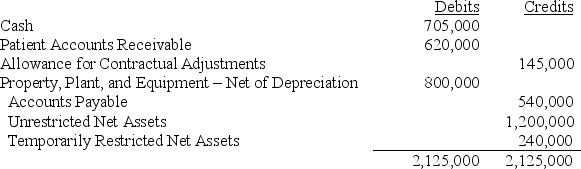

St. David's Hospital, a private not-for-profit, began the year 2017 with the following trial balance:

Transactions for 2017 are as follows:

a) Collected $340,000 of the Patient Accounts Receivable that was outstanding at 12-31-2016. Actual contractual adjustments on these receivables totaled $152,000.

b) The Hospital billed patients $2,350,000 for services rendered. Of this amount, 7% is expected to be uncollectible. Contractual adjustments with insurance companies are expected to total $792,000. Hint: use an allowance account to reduce accounts receivable for estimated contractual adjustments). The Hospital collected $1,235,000 of the amount billed to patients

c) In 2016 the Hospital had received a contribution of $240,000 to purchase new ultrasound equipment. The equipment was purchased for $300,000 in 2017.

d) Charity care in the amount of $60,000 at standard charges) was performed for indigent patients.

e) The Hospital received $700,000 in securities to establish a permanent endowment. Income from the endowment is unrestricted.

f) Other revenues collected in cash were: gift shop $11,000 and cafeteria $34,000.

g) The Hospital received in cash unrestricted interest income on endowments of $5,000. Unrealized gains on endowment investments totaled $7,000.

h) Expenses amounting to $1,160,000 for Professional Care of Patients, $340,000 for General Services, and $219,000 for Administration were paid in cash.

i) Depreciation on fixed assets, including the ultrasound equipment, totaled $125,000 for the year. $90,000 for Professional Care of Patients, $18,000 for General Services, and $16,000 for Administration.)

j) Closing entries were prepared.

Required:

A. Record the transactions described above.

B. Prepare in good form, a Statement of Operations for the year ended December 31, 2017

C. Prepare in good form, a Statement of Changes in Net Assets for the year ended December 31, 2017.

Definitions:

Q10: Proprietary funds are required to prepare a

Q38: Which of the following is true regarding

Q45: The AICPA Audit and Accounting Guide: Health

Q47: St. Paul's is a private not-for-profit hospital.

Q56: The general fund classified under governmental funds…<br>A)

Q66: Which of the following health care organizations

Q85: Fiduciary funds include agency, pension trust, investment

Q109: In a governmental audit, the auditor is

Q120: With the exception of collections, fixed assets

Q133: Under GASB, accrual accounting is used for:<br>A)