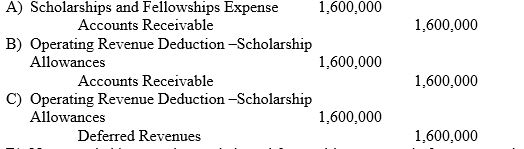

Tuition and fees for Northern University were assessed at $22,000,000. $ 1,600,000 of the amount due from students was later reduced by need based scholarships. Graduate assistantships and work-study stipends reduced the amounts collectible from student by an additional $ 1,000,000.

-What is the journal entry to record the scholarship allowances?

Definitions:

Coverdell Education Savings Account

A tax-advantaged saving account designed to pay for education expenses, from primary to higher education.

AGI

AGI (Adjusted Gross Income) is a measure of income calculated from your gross income and allows certain deductions to lower your taxable income, such as contributions to retirement accounts and student loan interest.

CESA Contribution

Contributions made to a Coverdell Education Savings Account that are designated for financing educational expenses.

Annuity Contract

A financial product sold by financial institutions that offers fixed or variable payments to an individual over time, often used for retirement savings.

Q8: Patient Service Revenue of hospitals is to

Q23: The AICPA Audit and Accounting Guide: Health

Q26: Which of the following use current financial

Q61: What is the difference between recording an

Q62: A private not-for-profit reports expenses in either

Q66: Revenue and expense on a government-wide statement

Q67: The Government Accountability Office has authority for

Q69: Private sector not-for-profit health care entities must

Q76: Which of the following would <u><b>not </b></u>

Q110: While governmental health care organizations follow GASB