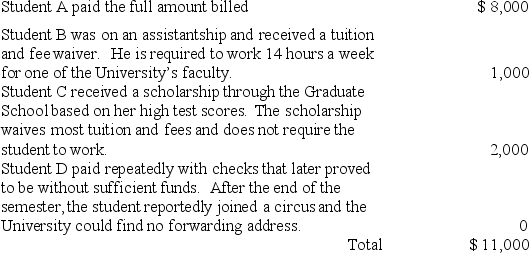

Ballard University, a private not-for-profit, billed four students for tuition and fees each in the amount of $ 8,000 each for fall semester. The University estimates 25% of tuition and fees will prove to be uncollectible. The University collected $ 10,000 as follows:

Required: Prepare the journal entries to record the billing and subsequent collection or write-off for the transactions listed above.

Definitions:

Expense Accounts

These accounts record the consumption of assets or services that occur during the operation of a business, leading to a decrease in owner's equity.

Revenue Accounts

Accounts in the general ledger that track the income generated by a company from its normal business operations.

Gain On Sale

The profit realized when a capital asset is sold for a higher price than its purchase price.

Property And Equipment

Tangible assets owned by a business for use in the production or supply of goods and services or for rental to others.

Q59: The difference between assets and liabilities of

Q61: FASB Statement 136 Transfer of Assets to

Q65: Private colleges and universities are required to

Q67: GASB 34 established four types of interfund

Q70: Which of the following is true concerning

Q73: Which of the following is <u><b>not</u></b>

Q77: Which of the following is a prohibited

Q93: Private colleges and universities use the same

Q127: The term "fiduciary funds" applies to:<br>A) enterprise

Q160: Which of the following is true regarding