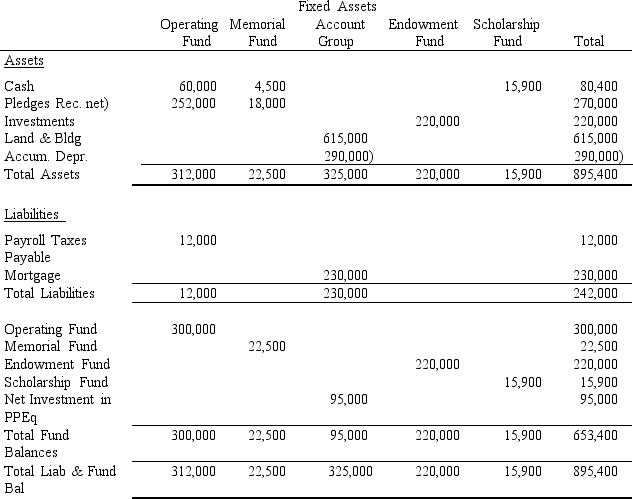

Union Seminary, a private not-for-profit college, uses the fund basis of accounting for internal record keeping. Presented below is the fully adjusted 12/31/2017 balance sheet for Union, prepared using funds and account groups. The following are fund descriptions:

Operating Fund - the fund used for transactions not falling within the definition of other funds. There are no restrictions on these resources.

Memorial Fund - Used to account for resources donated from outside parties for specific capital additions

Endowment Fund - Assets received from an outside donor for permanent investment, only the earnings may be expended.

Scholarship Fund - Cash set aside by the Seminary's governing board for use as scholarships and student aid.

Fixed Assets Account Group - A record of the Seminary's fixed assets and long-term debt.

Required: Prepare a Statement of Financial Position following the guidelines provided in FASB Statements 116 and 117 for private not-for-profits and assuming Union does not classify plant assets as temporarily restricted.

Definitions:

Q3: Financial reports for state and local governments

Q12: Identify the three types of temporary restrictions

Q20: Investor-owned proprietary schools are subject to the

Q32: The Health Care Guide makes a distinction

Q44: Which of the following is false regarding

Q52: Cash paid for interest is classified as

Q62: Voluntary health and welfare organizations raise a

Q73: The Statement of Budgetary Resources for a

Q84: Which of the following applies to governmental

Q140: The Statement of Functional expenses presents a