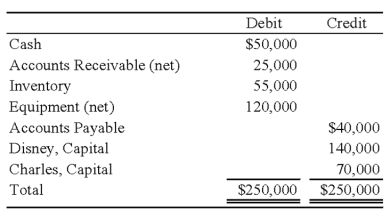

When Disney and Charles decided to incorporate their partnership, the trial balance was as follows:  The partnership's books will be closed, and new books will be used for D & C Corporation. The following additional information is available:

The partnership's books will be closed, and new books will be used for D & C Corporation. The following additional information is available:

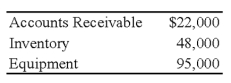

1. The estimated fair values of the assets follow:  2. All assets and liabilities are transferred to the corporation.

2. All assets and liabilities are transferred to the corporation.

3. The common stock is $5 par. Alice and Betty receive a total of 24,000 shares.

4. Disney and Charles share profits and losses in the ratio 6:4.

Required:

a. Prepare the entries on the partnership's books to record (1) the revaluation of assets, (2) the transfer of the assets to the D & C Corporation and the receipt of the common stock, and (3) the closing of the books.

b. Prepare the entries on D & C Corporation's books to record the assets and the issuance of the common stock.

Definitions:

Water

A colorless, transparent, odorless, liquid that forms the seas, lakes, rivers, and rain and is the basis of the fluids of living organisms.

Cytoskeleton

A network of fibers within a cell that provides structural support, cell shape, and enables cell movement.

Vesicle Formation

The process of creating small, membrane-bound sacs within a cell, used for transporting substances within a cell.

Cell Shape

The form and structure of a cell, which is often related to its function in the body or in a multicellular organism.

Q7: Upon arrival in Chile, Karen exchanged $1,000

Q9: Based on the information provided, what amount

Q13: Which of the following funds is used

Q15: Goodwill under the parent theory:<br>A) exceeds goodwill

Q24: Which of the following funds are classified

Q26: On July 1, 20X8, Cleveland established a

Q37: Refer to the information provided above. Using

Q40: Burrough Corporation paid $80,000 to acquire all

Q44: Based on the preceding information, income assigned

Q55: The GASB does not require supplementary information