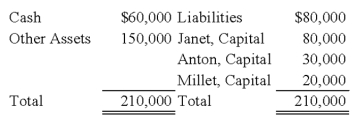

The balance sheet given below is presented for the partnership of Janet, Anton, and Millet:  The partners share profits and losses in the ratio of 5:3:2, respectively. The partners agreed to dissolve the partnership after selling the other assets for $50,000. On dissolution of the partnership, Janet should receive:

The partners share profits and losses in the ratio of 5:3:2, respectively. The partners agreed to dissolve the partnership after selling the other assets for $50,000. On dissolution of the partnership, Janet should receive:

Definitions:

Cash Dividends

Payments made by a company to its shareholders from its profits in the form of cash.

Newly Issued Stock

This refers to shares that a company offers for sale to the public for the first time, outside of the shares already trading on the stock market.

Dividend Reinvestment Plans

Programs offered by corporations that allow investors to automatically reinvest their cash dividends in additional shares of the company's stock on the dividend payment date.

Preferred Stock

A type of stock that typically pays dividends at a fixed rate and has priority over common stock in terms of dividend payments and assets in the event of liquidation.

Q20: On January 1, 20X8, Zeta Company acquired

Q27: Based on the preceding information, what balance

Q35: Refer to the above information. Which statement

Q37: Based on the preceding information, in the

Q39: Based on the preceding information, what amount

Q45: Which of the following characteristics would not

Q49: Pisa Company acquired 75 percent of Siena

Q50: The entry to record the expiration of

Q119: Permanent funds can be either a governmental

Q147: Which of the following has established a