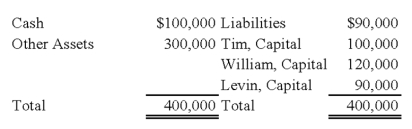

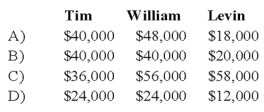

On December 1, 20X9, the partners of Tim, Williams, and Levin, who share profits and losses in the ratio of 4:4:2, decided to liquidate their partnership. On this date the partnership condensed balance sheet was as follows:  On December 11, 20X9, the first cash sale of other assets with a carrying amount of $200,000 realized $140,000. Safe installment payments to the partners were made on the same date. How much cash should be distributed to each partner?

On December 11, 20X9, the first cash sale of other assets with a carrying amount of $200,000 realized $140,000. Safe installment payments to the partners were made on the same date. How much cash should be distributed to each partner?

Definitions:

Recognized Gain

The amount of profit that is realized from the sale of assets that must be reported for tax purposes.

Adjusted Basis

The original cost of a property adjusted for factors such as depreciation or improvements, used to calculate capital gains or losses for tax purposes.

Recognized Gain

The profit earned from the sale of an asset that must be reported for tax purposes.

Adjusted Basis

The original cost of a property adjusted for improvements, depreciation, and certain other factors, used to calculate capital gains or losses.

Q3: Financial reports for state and local governments

Q4: Based on the information given above, what

Q15: Which of the following statements is (are)

Q23: Based on the information provided, in the

Q34: The costs of enterprise fund activities are

Q73: The FASAB has the authority to establish

Q91: Contrast the reporting of mergers and acquisitions

Q93: What basis of accounting would the Enterprise

Q114: Fiduciary funds of a governmental unit use

Q123: The Statement of Cash Flows for a