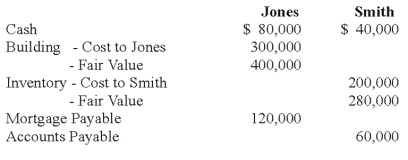

Jones and Smith formed a partnership with each partner contributing the following items:  Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

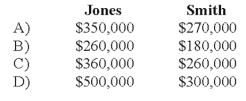

-Refer to the above information. What is each partner's tax basis in the Jones and Smith partnership?

Definitions:

Management Responsibilities

The duties and tasks associated with directing and controlling an organization or one of its units, including planning, organizing, leading, and controlling.

Invest

The act of allocating resources, usually money, with the expectation of generating an income or profit.

Double Taxation

A situation where the same income is taxed twice, typically once at the corporate level and again at the personal level when distributed as dividends.

Corporation

A legal entity that is separate and distinct from its owners, who are shareholders, and has its own rights, privileges, and liabilities.

Q10: If Push Company owned 51 percent of

Q11: Based on the preceding information, on the

Q25: Based on the preceding information, what amount

Q33: GASB utilizes two additional elements that do

Q35: Based on the preceding information, what amount

Q45: Infinity Corporation acquired 80 percent of the

Q57: The general fund of Athens ordered computer

Q66: Which of the following fund types is

Q90: Private not-for-profits must follow all applicable FASB

Q98: Private not-for-profits must follow all applicable FASB