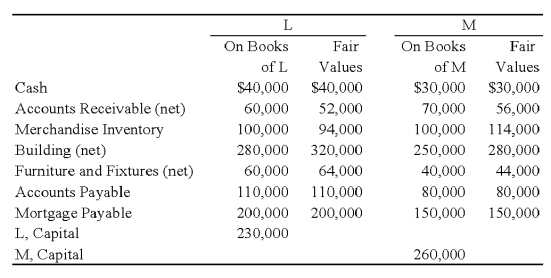

Two sole proprietors, L and M, agreed to form a partnership on January 1, 2009. The trial balance for each proprietorship is shown below as of January 1, 2009.  The LM partnership will take over the assets and assume the liabilities of the proprietors as of January 1, 2009.

The LM partnership will take over the assets and assume the liabilities of the proprietors as of January 1, 2009.

Required:

a) Prepare a balance sheet, for financial accounting purposes, for the LM partnership as of January 1, 2009.

b) In addition, assume that M agreed to recognize the goodwill generated by L's business. Accordingly, M agreed to recognize an amount for L's goodwill such that L's capital equaled M's capital on January 1, 2009. Given this alternative, how does the balance sheet prepared for requirement A change?

Definitions:

Purchase Method

An accounting approach used to consolidate the financial statements of a buyer and a target company after an acquisition.

Diseconomies of Scale

The phenomenon where, beyond a certain point, the cost per unit increases as the scale of operations expands.

Firm Size

A measure of a company's scale or magnitude, often estimated by metrics like sales, assets, or the number of employees.

Q8: Based on the information given above, what

Q11: Based on the information provided, what amount

Q13: On January 1, 20X9, Light Corporation sold

Q23: Company X issues variable-rate debt but wishes

Q33: GASB utilizes two additional elements that do

Q52: Based on the preceding information, which of

Q53: The only objective of the Governmental Accounting

Q59: A membership pass to the YMCA a

Q121: Which of the following is an environmental

Q144: A donor gave equipment valued at $60,000