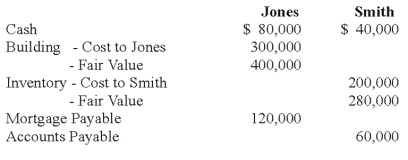

Jones and Smith formed a partnership with each partner contributing the following items:  Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

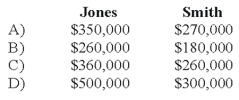

-Refer to the above information. What is the balance in each partner's capital account for financial accounting purposes?

Definitions:

Sales And Profitability

measures of the effectiveness of a company's operations; where sales refer to the revenue from goods or services sold, and profitability is the extent to which this revenue exceeds the costs incurred.

Historical Approach

A method of research that examines past events and developments to understand the present and anticipate future trends.

Desired Performance

A target level of performance set by an individual or organization to achieve specific goals.

Actual Performance

The real, observed outcomes of a person's work or the execution of a specific task.

Q1: Private not-for-profit organizations are required to present

Q4: Based on the preceding information, what amount

Q7: A change from the cost method to

Q12: The GASB is under the oversight of:<br>A)

Q26: Which of the following funds provides goods

Q42: Some rivers have been dammed under the

Q43: Refer to the facts in Question 46.

Q100: With respect to a not-for-profit that holds

Q128: The Federal Accounting Standards Advisory Board requires

Q160: Identify the standard setting body for private