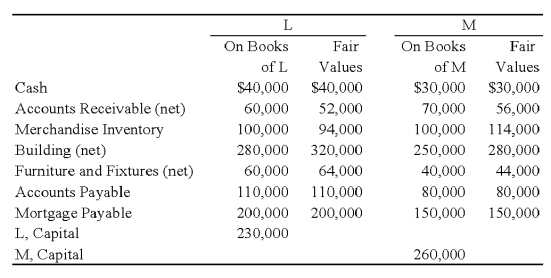

Two sole proprietors, L and M, agreed to form a partnership on January 1, 2009. The trial balance for each proprietorship is shown below as of January 1, 2009.  The LM partnership will take over the assets and assume the liabilities of the proprietors as of January 1, 2009.

The LM partnership will take over the assets and assume the liabilities of the proprietors as of January 1, 2009.

Required:

a) Prepare a balance sheet, for financial accounting purposes, for the LM partnership as of January 1, 2009.

b) In addition, assume that M agreed to recognize the goodwill generated by L's business. Accordingly, M agreed to recognize an amount for L's goodwill such that L's capital equaled M's capital on January 1, 2009. Given this alternative, how does the balance sheet prepared for requirement A change?

Definitions:

Units

Refers to a single, distinct item or entity that is part of a larger quantity, often used in the context of measurement or count.

Utility Function

A mathematical representation that ranks an individual's preference for different combinations of goods or outcomes.

Budget Constraint

The limit on the consumption bundles that a consumer can afford to purchase, based on their income and the prices of goods and services.

Income

Income that is earned from work or investments, which is typically received at regular intervals.

Q7: Blue Company owns 70 percent of Black

Q14: Which of the following items should not

Q30: The ABC partnership had net income of

Q31: On January 1, 20X8, Line Corporation acquired

Q32: Which of the following observations is NOT

Q49: Refer to the information given. Assuming a

Q68: According to the GASB, Capital assets:<br>A) must

Q89: Under GASB, modified accrual accounting would be

Q90: Private not-for-profits must follow all applicable FASB

Q150: According to GASB standards relating to Budgetary