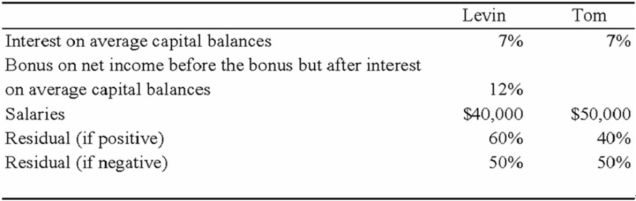

Net income for Levin-Tom partnership for 2009 was $125,000. Levin and Tom have agreed to distribute partnership net income according to the following plan:  Additional Information for 2009 follows:

Additional Information for 2009 follows:

1. Levin began the year with a capital balance of $75,000.

2. Tom began the year with a capital balance of $100,000.

3. On March 1, Levin invested an additional $25,000 into the partnership.

4. On October 1, Tom invested an additional $20,000 into the partnership.

5. Throughout 2009, each partner withdrew $200 per week in anticipation of partnership net income. The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purposes of income distributions.

Required:

a. Prepare a schedule that discloses the distribution of partnership net income for 2009. Show supporting computations in good form.

b. Prepare the statement of partners' capital at December 31, 2009.

c. How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $45,000 to Levin and $60,000 to Jack?

Definitions:

Continental Crust

The layer of igneous, sedimentary, and metamorphic rocks that forms the continents and the areas of shallow seabed close to their shores, known as continental shelves.

Rifting

The process of continental crust being pulled apart, leading to the formation of new oceanic crust and the expansion of ocean basins.

Salt Domes

Geological formations created when a thick bed of evaporite minerals (primarily salt) is pushed upward by the pressure of overlying rock layers.

Less Dense

Describes materials that have a lower mass per unit volume compared to others, often leading to buoyancy in fluids.

Q7: Upon arrival in Chile, Karen exchanged $1,000

Q18: Ponca City issued general obligation bonds to

Q25: The FASAB requires more financial statements than

Q26: The British subsidiary of a U.S. company

Q38: Based on the preceding information, on the

Q46: Preserving biodiversity can increase the value of

Q49: What is the correct sequence in the

Q51: Enterprise and internal service funds should recognize

Q115: Which of the following fund types uses

Q152: A donor gave $60,000 to a nongovernmental,