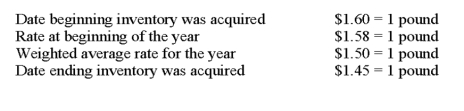

The British subsidiary of a U.S. company reported cost of goods sold of 75,000 pounds (sterling) for the current year ended December 31. The beginning inventory was 10,000 pounds, and the ending inventory was 15,000 pounds. Spot rates for various dates are as follows:  Assuming the pound is the functional currency of the British subsidiary, the translated amount of cost of goods sold that should appear in the consolidated income statement is:

Assuming the pound is the functional currency of the British subsidiary, the translated amount of cost of goods sold that should appear in the consolidated income statement is:

Definitions:

Discarding

The act of getting rid of something that is no longer useful or desired, within a context like inventory management or manufacturing.

Fixed Assets

Permanent tangible properties engaged in business operations, which are unlikely to be used up or exchanged for cash in the span of a year.

Goodwill

An intangible asset that is created from such favorable factors as location, product quality, reputation, and managerial skill.

Competitive Advantage

An advantage that allows a business to generate greater sales or margins compared to its market competitors, often through unique resources, capabilities, or efficiencies.

Q1: Which of the following correctly lists the

Q6: Based on the preceding information, the journal

Q23: Based on the preceding information, all of

Q26: Phobos Company holds 80 percent of Deimos

Q46: Based on the information given above, what

Q46: The FASB has the authority to set

Q54: Which of the following methods may help

Q80: Fiduciary funds use the:<br>A) economic resources measurement

Q106: Businesslike activities fund statements must be changed

Q118: For most state and local governments, the