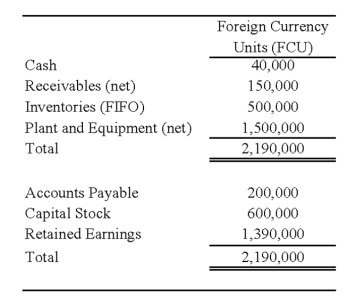

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

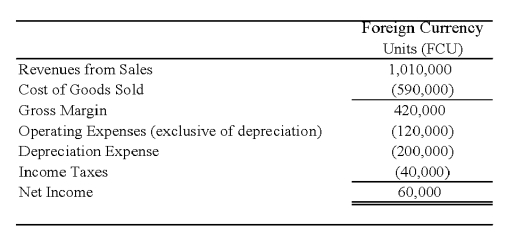

Perth's income statement for 20X8 is as follows:  The balance sheet of Perth at December 31, 20X8, is as follows:

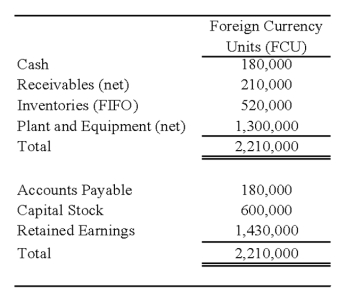

The balance sheet of Perth at December 31, 20X8, is as follows:  Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

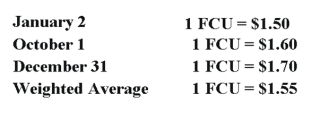

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:  Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

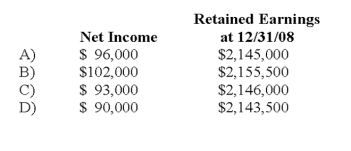

-Refer to the above information. Assuming the local currency of the country in which Perth Company is located is the functional currency, what are the translated amounts for the items below in U.S. dollars?

Definitions:

Q4: Based on the information given above, what

Q9: Pollution is defined as<br>A) an alteration in

Q24: Which combination of accounts and exchange rates

Q28: Based on the figure shown here, which

Q36: The major cause of the loss in

Q45: Infinity Corporation acquired 80 percent of the

Q46: Dish Corporation acquired 100 percent of the

Q47: A keystone species is<br>A) the largest species

Q59: On January 1, 2008, Pace Company

Q62: Desertification is primarily caused by which of