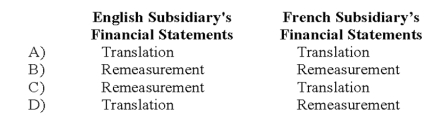

Simon Company has two foreign subsidiaries. One is located in France, the other in England. Simon has determined the U.S. dollar is the functional currency for the French subsidiary, while the British pound is the functional currency for the English subsidiary. Both subsidiaries maintain their books and records in their respective local currencies. What methods will Simon use to convert each of the subsidiary's financial statements into U.S. dollars?

Definitions:

Security Deposit

Funds provided by a tenant to a landlord at the start of a lease as protection against damage or non-payment of rent, usually refundable under certain conditions.

Rental Income

Income received from renting out property, such as real estate or personal property, which must be reported on tax returns and is subject to income tax.

Tax Year

The 12-month period for which tax is calculated. It can be a calendar year or a fiscal year, depending on the taxpayer.

Depreciation Expense

A non-cash expense that reduces the value of an asset over time due to wear and tear, ageing, or obsolescence.

Q3: A parent sold land to its partially

Q14: When a partner retires from a partnership

Q16: Which of the following human behaviors is

Q19: Dover Company owns 90% of the capital

Q31: Tanner Company, a subsidiary acquired for cash,

Q37: Shue, a partner in the Financial Brokers

Q38: Refer to the information in question 52.

Q53: Which of the following accounts could be

Q53: Which of the following organizations would not

Q65: GASB 31 "Accounting for Financial Reporting for