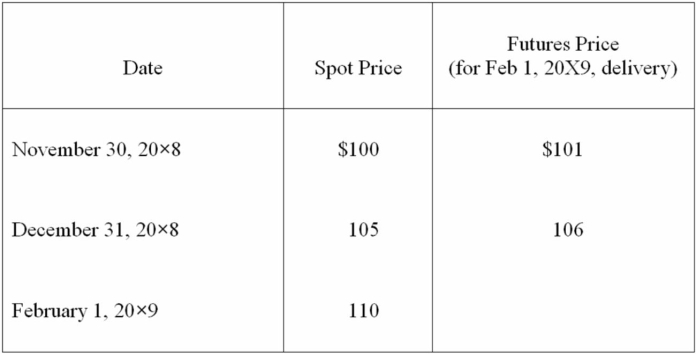

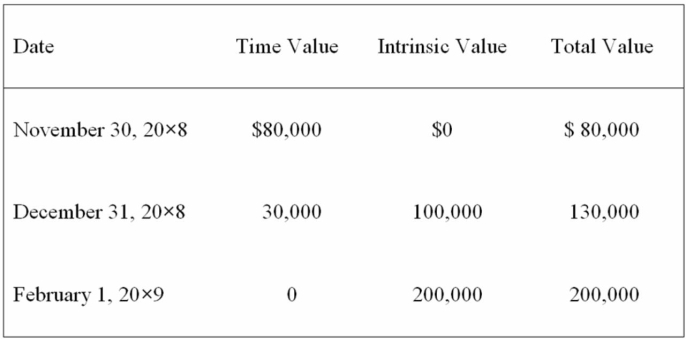

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:  The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows:  On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

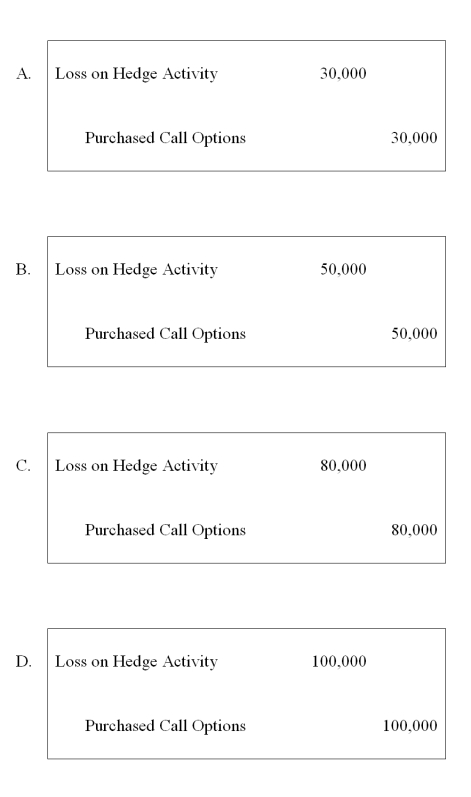

-Based on the preceding information, which of the following adjusting entries would be required on December 31, 20X8?

Definitions:

Apparent Authority

A form of authority that a third party reasonably believes an agent has, based on the principal's behavior or words, which can bind the principal to agreements made by the agent.

Authorizing Document

An official document that grants permission or authority for certain actions or activities.

Ratify

To officially sanction or ratify an agreement or treaty, thereby making it legally binding.

Contractual Capacity

The legal ability of a party to enter into a contract, including being of legal age and having sound mind.

Q1: Based on the information given, what percentage

Q8: Quid Corporation acquired 75 percent of Pro

Q13: On a partner's personal statement of financial

Q17: Based on the information given above, at

Q30: On January 1, 20X9 Athlon Company acquired

Q38: Based on the preceding information, on the

Q44: Based on the preceding information, the entries

Q46: Based on the preceding information, what will

Q51: Refer to the above information. Assuming the

Q123: Which of the following fund types uses