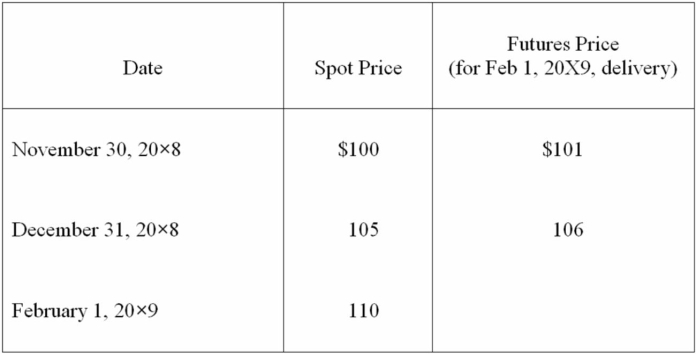

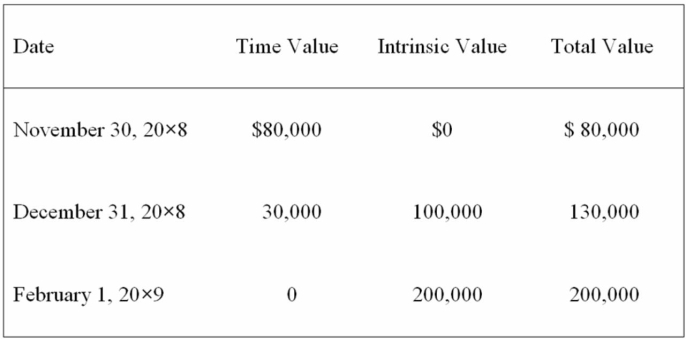

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:  The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows:  On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

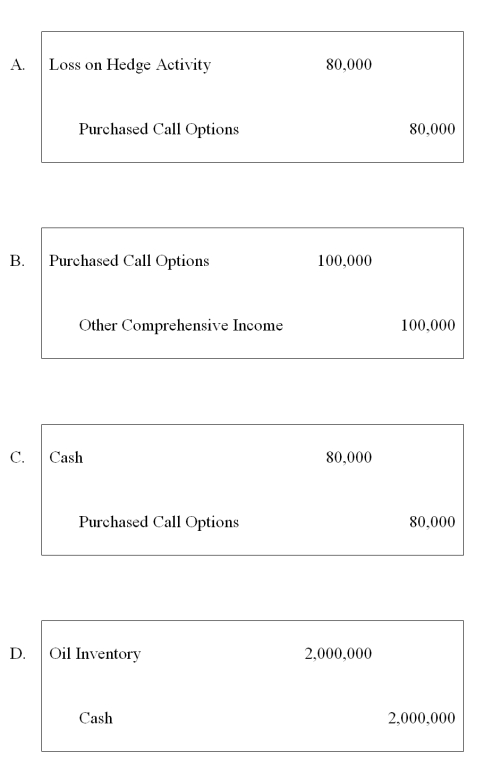

-Based on the preceding information, which of the following entries will be required on February 1, 20X9?

Definitions:

Study Material

encompasses a broad range of physical or digital resources designed to aid in the process of learning and understanding subjects or topics.

Incidental Learning

The subconscious acquisition of knowledge and skills occurring from activities not specifically designed for learning.

Manipulated

Altered or controlled in a deliberate way, often to achieve a specific effect in an experiment or study.

Recall

The act of retrieving information or memories from the past, with or without the use of an explicit cue.

Q6: SeaLine Corporation is involved in the distribution

Q11: Based on the preceding information, what amount

Q11: On January 1, 20X7, Plimsol Company acquired

Q18: Based on the preceding information, the amount

Q24: Which of the following stockholders equity accounts

Q30: The ABC partnership had net income of

Q32: Biomes are defined by<br>A) their size.<br>B) types

Q35: When a parent and its subsidiary use

Q38: Transferable interest of a partner includes all

Q135: The term "proprietary funds" applies to:<br>A) all