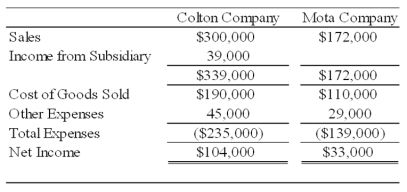

Colton Company acquired 80 percent ownership of Mota Company's voting shares on January 1, 2008, at underlying book value. The fair value of the noncontrolling interest on that date was equal to 20 percent of the book value of Mota Company. During 2008, Colton purchased inventory for $30,000 and sold the full amount to Mota Company for $50,000. On December 31, 2008, Mota's ending inventory included $10,000 of items purchased from Colton. Also in 2008, Mota purchased inventory for $80,000 and sold the units to Colton for $100,000. Colton included $30,000 of its purchase from Mota in ending inventory on December 31, 2008. Summary income statement data for the two companies revealed the following:  Required:

Required:

a. Compute the amount to be reported as sales in the 20X8 consolidated income statement.

b. Compute the amount to be reported as cost of goods sold in the 20X8 consolidated income statement.

c. What amount of income will be assigned to the noncontrolling shareholders in the 20X8 consolidated income statement?

d. What amount of income will be assigned to the controlling interest in the 20X8 consolidated income statement?

Definitions:

Q5: Based on the information given above, what

Q12: Based on the preceding information, what amount

Q22: Based on the preceding information, what amount

Q28: The fovea of the eye is<br>A) the

Q32: Based on the information given above, the

Q39: Which of the following explanations about the

Q41: On a partner's personal statement of financial

Q46: When Disney and Charles decided to incorporate

Q47: Under the temporal method, which of the

Q65: An enterprise fund of Grist was billed