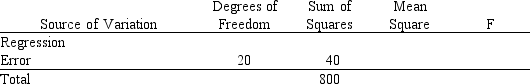

Below you are given a partial ANOVA table relating the price of a company's stock (y in dollars), the Dow Jones industrial average (x1), and the stock price of the company's major competitor (x2 in dollars).

a.What has been the sample size for this regression analysis?

b.At = 0.05 level of significance, test to determine if the model is significant. That is, determine if there exists a significant relationship between the independent variables and the dependent variable.

c.Determine the multiple coefficient of determination.

Definitions:

Statutory Interpretation

The process by which courts read and apply statutes, often involving the examination of the language, context, and intent behind the legislation.

Ambiguity

A lack of clarity or certainty in meaning in language, often leading to confusion or multiple interpretations.

Natural Law Defense

A legal argument grounded in the belief that certain laws are inherent or universal and can serve as a justification or defense for actions in legal proceedings.

Judges

Officials appointed or elected to decide cases in a court of law, interpret legal statutes, and administer justice according to the law.

Q14: The trend pattern is easy to identify

Q22: The numerical value of the coefficient of

Q22: A lottery is conducted that involves the

Q35: Refer to Exhibit 15-3. The forecast for

Q52: During "sweeps week" last year, the viewing

Q53: DSS and MIS are also referred to

Q58: Refer to Exhibit 12-4. The least squares

Q75: Which of the following systems is designed

Q109: In a random sample of 200 Republicans,

Q138: The management of Recover Fast Hospital (RFH)