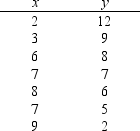

Given below are seven observations collected in a regression study on two variables, x (independent variable) and y (dependent variable).

a.Develop the least squares estimated regression equation.

b.At 95% confidence, perform a t test and determine whether or not the slope is significantly different from zero.

c.Perform an F test to determine whether or not the model is significant. Let 0.05.

d.Compute the coefficient of determination.

Definitions:

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term liquidity and health of the company.

Current Ratio

The Current Ratio is a liquidity ratio that measures a company's ability to pay short-term obligations with its short-term assets, indicating its financial health.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within the operating cycle of the business.

Q2: When using Excel to calculate a p-value

Q19: A company has recorded data on the

Q26: An important application of the chi-square distribution

Q44: Juran proposed a simple definition of quality:<br>A)customer

Q57: If the coefficient of correlation is a

Q74: You are given the following information on

Q77: If we are interested in testing whether

Q92: In ANOVA, which of the following is

Q114: Information regarding the ACT scores of samples

Q165: Refer to Exhibit 10-1. The p-value is<br>A)0.0668<br>B)0.0334<br>C)1.336<br>D)1.96