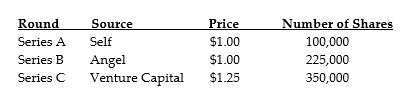

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO, issuing 1 million new shares. Assuming that they successfully complete the IPO, the net income for the next year is estimated to be $6 million. The price of shares is set using average price-earnings ratios for similar businesses of 15. What portion of the company will be owned by the angel investor after the IPO?

Definitions:

Q8: If a business owner is using the

Q9: A firm has $80 million in equity

Q15: A firm has $75 million of assets

Q16: What are the ways in which a

Q51: A company issues a callable (at par)

Q55: What role does the correlation of two

Q74: Managerial entrenchment means that managers _ and

Q77: What are the characteristics of special dividend?

Q94: One of the shortcomings of the percent

Q106: Because _ are seen as an implicit